A mill is one dollar of tax for every $1,000 of the assessed property value.

State law requires that a rollback millage rate be computed for the maintenance and operations fund, also called the general fund, that will produce the same total revenue on the current year’s new tax digest that last year’s millage rate would have produced had no reassessments occurred.

“The district commissioners and I are pleased that we are able to roll back the general fund millage rate and still meet our service commitments while maintaining a balanced budget. We appreciate the good work by County officials and staff that made this possible,” said Board Chairman Charlotte Nash.

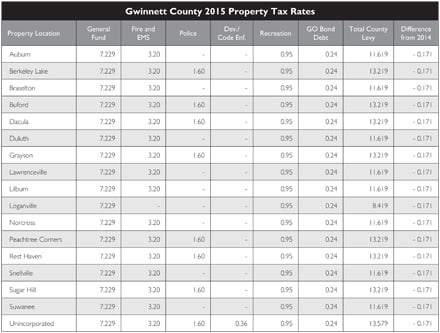

Millage rates in Gwinnett County vary based on a property’s location and what services the county provides. The total millage rate in unincorporated areas will be 13.579, down slightly from last year. Rates for three service districts will remain the same: fire and emergency medical services (3.20 mills), police (1.60 mills) and development and code enforcement (.36 mills). In addition, the countywide levy for both voter-approved debt and recreation remain unchanged at .24 and .95 mills, respectively, while the general fund rollback rate is 7.229 mills. A table detailing millage rates in different areas of the county has been published online at www.gwinnettcounty.com or click here.

This action by commissioners also paved the way for the Tax Commissioner’s Office to prepare property tax bills for mailing by Aug. 15 with a payment due date of Oct. 15.