Let’s look at a “perfect world” example. Assume you paid no taxes, saw no inflation, never encountered any setbacks such as unemployment or disabilities, and you made $60,000 each year and every year for 30 years saved $10,000 faithfully….and you wanted to maintain the same standard of living (living on about $50,000 a year)….how long before your retirement money runs out?

Assuming no growth on your “savings” of $10,000 a year for 30 years, you would have saved $300,000 at retirement. To retire on the $50,000 a year you are used to living on (assuming no other sources of income and no continued need to save), your $300,000 would only last for six years of retirement!! If you retire at age 65, this would only carry you through age 71. What will you do if you live beyond that age?

Using the same set of “perfect world” example figures, it would take 150 years to save, without growth, for a 30 year retirement to cover you until age 95.

One thing that can help you accrue enough assets to last during your retirement is GROWTH. I consider growth to be the most important part of retirement planning for all but the extremely wealthy. And I believe most people will need to continue achieving growth on investments during retirement to make their assets last throughout retirement.

Needing a $1 million dollar portfolio is not unthinkable with the impacts of inflation and taxes on the value of that money 10, 20, or 30 years from now. You may not, however, have to enter retirement with that amount of money, as you may be able to continue growing the assets you are not yet drawing from in retirement. Since many people now spend 15-30 years in retirement, additional growth during this time will help your money last longer.

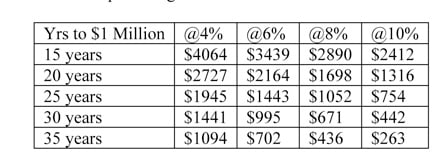

The chart below puts the impact of growth in perspective, showing the monthly savings required at different percentage rates of return:

These examples are for illustrative purposes only, and the rates of return are hypothetical and do not represent the returns of any particular investment, but you can see the impact of being able to achieve growth on your investments, as well as the benefits of starting as early as possible.

There are investments available that have historically provided rates of return shown in the chart, and that can help you pursue your retirement goals. Very few investments of any type are guaranteed and past results are no guarantee of future earnings. A financial professional can help you determine the mix of investments that may help you increase the odds of achieving your financial goals through growth.

To increase your knowledge of growth, compounding, and investing – and the taxes and inflation that eat away at your retirement assets — and much more, register for Successful Retirement Planning at Gwinnett Technical College. Register by calling the college at 770.995.9697 or go to www.GwinnettTech.edu/CE and search for Successful Retirement Planning. If you don’t have time to attend class, call us at 770.931.1414 to schedule a free consultation to review your retirement planning situation for potential growth opportunities. For more information, please visit our website at www.rogersgreen.com.

Roger S. Green is a registered Representative with Cetera Advisors LLC, member FINRA/SIPC, with Green Financial Resources, LLC located at 3700 Crestwood Parkway, Duluth, GA 30096. Neither Green Financial nor Gwinnett Technical College is affiliated with Cetera Advisors LLC. Hear more “Your Green”, Saturdays at 3 PM, on WNIV 970 AM or live at http://www.faithtalk970.com. Visit Roger’s website at http://www.rogersgreen.com.