~ Set goals for yourself. Financial goals help keep you focused and help you decide where you really want to go.

~ Create an emergency fund. Be prepared for the unexpected financial challenge. Before you begin investing, set aside at least 3 months living expenses (including car payments, bills, entertainment, etc…) to protect you should you lose your job or suffer some unexpected health issue that affects your ability to work.

~ Set up an automatic payroll deposit into an investment or savings account. Get used to living on a percentage of what you actually take home – and put the rest into an investment account or a savings account. This works in your favor because it removes the temptation to spend the money and helps you develop good saving habits. This is what they mean when you hear “pay yourself first”.

~ Protect yourself from risk. It is critical to make sure you have at least catastrophic medical insurance coverage no matter how healthy you believe you are. Review your situation to determine what other areas could be financially devastating without insurance protection and seek coverage.

~ Use credit wisely. The credit record you establish now will either help you or haunt you for years. Bad credit will cost you tremendously over time by forcing you to pay higher interest for loans and credit cards; potentially disqualifying you from buying a home, and by preventing you from obtaining funding should you decide to go into business for yourself. If you have student loans, make sure you are making payments on them as required. Make more than the minimum payment on your credit cards, or pay them off in full monthly. Pull your credit report for review at least annually. Live within your means. Don’t spend money you don’t have, and learn to separate your true needs from your wants and desires. Put your attention toward meeting your needs and responsibilities first.

~ Carefully weigh the decision to use student loans – If starting college and considering using student loans to attend a more expensive college than you can afford, carefully consider the long-term impact of that debt on your adult lifestyle. Think about what you could be doing in your future with the money you will be paying for years on your student loans. Is it really worth having to pay chunks of your income toward student loans every month for many years after you graduate? How will that impact your ability to live the adult life you imagine for yourself? Would it be wise to find ways to lower your overall college expenses to lessen the impact of loans on your future? One solution could be to consider a community college or in-state school for at least your first two years of college. There are many ways to lessen your college expenses, starting with maintaining good grades in high school.

~ We caution parents about co-signing for student loans. LendEDU, an online marketplace for student loans and refinancing recently did a survey and found that nearly 57% of parents said their credit score has been negatively affected by co-signing for a student loan, and 58% said their children have asked them for help making payments. The survey said that 34% of parents responded that co-signing has hurt their ability to qualify for their own mortgages, auto loans, and other types of financing.

~ Max out your company’s 401K. Participate in any 401k or similar retirement plan your employer offers. If they match your contributions, put in enough to get the full amount they will match, as this is free money! If your employer doesn’t offer a 401(k), ask them why. We can help a small business establish a plan for their employees. If you are in a 401(k) plan, make sure you have selected diversified funds within the account – don’t put all your eggs in one basket, especially the employer stock basket. For most people, this is the best way to start investing for your future.

~ If you are ready to settle down, and have a stable income or expect continued income growth, consider buying instead of renting. Housing prices and interest rates are both low, but rising, making now a good time for many to become home owners. Make sure you are ready to take on the responsibility for the time and expense of caring for and maintaining your home inside and out. If you are truly ready, then home ownership also may provide you with mortgage interest tax deductions and the opportunity to build equity in real estate.

~ Learn the power of growth and start early. Even relatively small amounts of money can grow into an impressive figure if you start now. With 40+ years before retirement on your side, you have time to grow your assets through compounding and investment earnings potentially achieved through growth-oriented equity investments. No 401k plan offered at work or wanting to establish investments outside of your 401k? Consult a financial professional about setting up an IRA, Roth IRA or other type of investment account and start investing now for long-term growth.

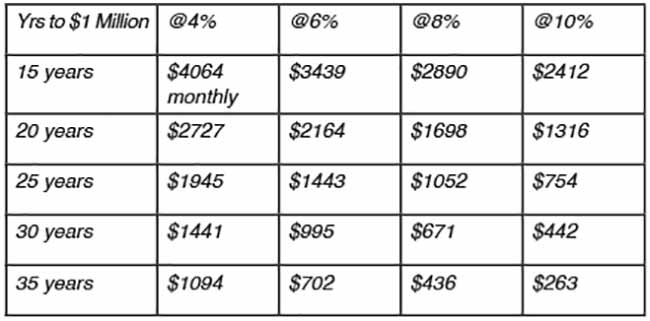

To further convince you of the power of growth, you’d have to save almost $29,000 a year or about $2417 a month for 35 years to have a million dollars for retirement in the absence of compounded growth on your assets. With growth, you can potentially have $1million in 35 years by saving less than half the monthly amount – only $1094 monthly if you achieve a 4% growth rate on your investments. Or you can potentially achieve a $1million portfolio within a much shorter 15 years by saving $2890 monthly at a higher 8% rate of return. Compounded growth makes a big difference over time. See the chart below for more examples of how you can potentially reach a million dollars with these monthly investment amounts:

~ Put “surprise” cash into savings. If you come into extra or unexpected money – a company bonus, a holiday gift from a relative, an inheritance, or all that graduation money you have rolling in – always set aside at least a portion for your future.

If you are looking to get started early with a long-term investment plan, and a focus on your financial future, we can help. Contact 770.931.1414 to schedule a free consultation to review your situation in person, or visit our website at www.rogersgreen.com.

Roger S. Green is an independent Investment Advisor Representative offering securities and advisory services through Cetera Advisors LLC, a Registered Investment Advisor and Broker/Dealer, member FINRA, SIPC. Green Financial and Cetera Advisors are not affiliated. Roger’s office is located at 3700 Crestwood Parkway, Duluth, GA 30096.