Let’s look at a “perfect world” example. Assume you paid no taxes, saw no inflation, never encountered any setbacks such as unemployment or disabilities, and you made $60,000 each year, and every year for 30 years saved $6,000 (10% or $500 a month) faithfully. If you wanted to maintain the same standard of living (living on about $60,000 a year) … how long before your retirement money runs out?

Assuming no growth on your “savings” of $6,000 a year for 30 years, you would have saved $180,000.00 at retirement. To retire on the $60,000 a year you think you need to live comfortably, let’s assume you need to withdraw $25,000 from your savings to get to your $60,000 after estimating a $35,000 annual Social Security payment for this example, your $180,000 would only last slightly over seven years of retirement if you withdrew $25,000 annually! If you retire at age 67, this would only carry you through age 74. What will you do if you live beyond that age? How will your life change if at age 72 your monthly income dropped over 40%?

Using the same set of “perfect world” example figures, it would take 125 years to save at that $6,000 annual savings rate, without growth, for a 30 year retirement to cover you until age 97 ($6,000 x 125 years = $750,000 saved and $750,000 divided by $25,000 needed annually = 30 years).

Many people actually expect to do things they have never really done once they retire; at least in their early retirement years. Many dream of traveling the world, having more time for visiting family out of state, taking up hobbies like golf or boating – things they perhaps didn’t get to do while working full-time and raising a family. Healthcare needs and costs also tend to increase when you are older, potentially eating up a higher percentage of your income. So, if you think you will be able to live on less in retirement; that may not be true. You actually may want more money to live on, at least in your earlier retirement years.

One thing that can help you accrue enough assets to last during your retirement and potentially enrich your retirement is GROWTH through investing. I consider growth to be by far the most important part of retirement planning for all but the extremely wealthy. And I believe most people will need to continue achieving growth on investments even throughout their retirement to make their assets last and to give them a chance at the retirement quality of life they desire.

As you can see by the earlier example, needing a $1 million portfolio is not unthinkable, and we haven’t even covered the impact of inflation and taxes on the value of your money 10, 20, or 30 years from now. You may not, however, have to enter retirement with all that you need for your expected retirement period. You may be able to continue investing to try to grow the assets you are not needing to draw from for the next few years during your entire retirement period. Since longer life spans now have many people spending 15- 30 or more years in retirement, additional growth on your assets during this time will help your money last longer.

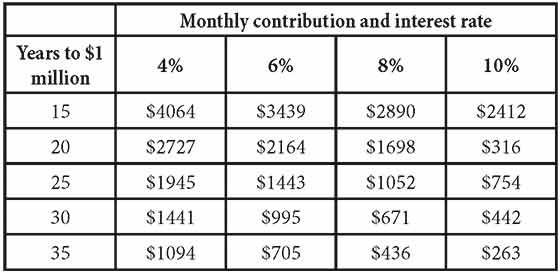

The chart below puts the impact of growth in perspective, showing the monthly savings required at different percentage rates of return.

These examples are for illustrative purposes only, and the rates of return are hypothetical and do not represent the returns of any particular investment, but you can see the impact of being able to achieve growth on your investments, as well as the benefits of starting as early as possible.

There are investments available that have historically provided rates of return shown in the chart, and that can help you pursue your retirement goals. Very few investments of any type are guaranteed and past results are no guarantee of future earnings. A financial professional can help you determine the mix of investments that may help you increase the odds of achieving your financial goals through growth.

I also have a “retirement harvesting plan” to help you try to achieve such growth before and during retirement, and to withdraw your money in a strategic manner during retirement to allow you to continue investing for the potential growth most will need.

Do yourself a favor – to increase your knowledge of growth, compounding, investing, the taxes and inflation that eat away at your retirement assets, and my retirement harvesting plan – register for one of my upcoming retirement planning classes at Gwinnett Technical College. Visit www.rogersgreen.com for more information on upcoming dates/times.

If you don’t have time to attend class, call us at 770.931.1414 or visit www.rogersgreen.com to schedule a free consultation to review your retirement planning situation for potential growth opportunities. I’ve been teaching retirement planning classes for over 20 years and have been helping people with their money for over 30 years, so no matter what your situation may be, we are here to help!

This information is not intended to be tax or legal advice, and it may not be relied upon for the purpose of avoiding any federal or state tax penalties. Roger S. Green is a Registered Representative, offering securities and advisory services through Cetera Advisors LLC, a Registered Investment Advisor (RIA) and broker/dealer, member FINRA/SIPC. His office is located at 3700 Crestwood Parkway Duluth, GA 30096. Green Financial, Cetera Advisors, and Gwinnett Tech are not affiliated.