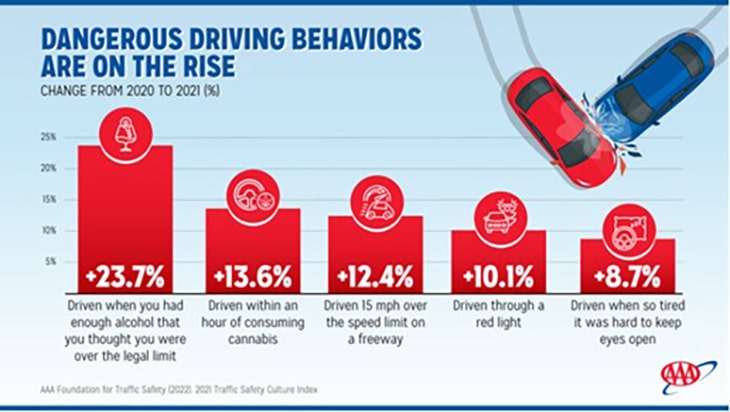

A new AAA report reveals that unsafe driving behaviors increased from 2020 to 2021. The increase comes after three years of steady declines.

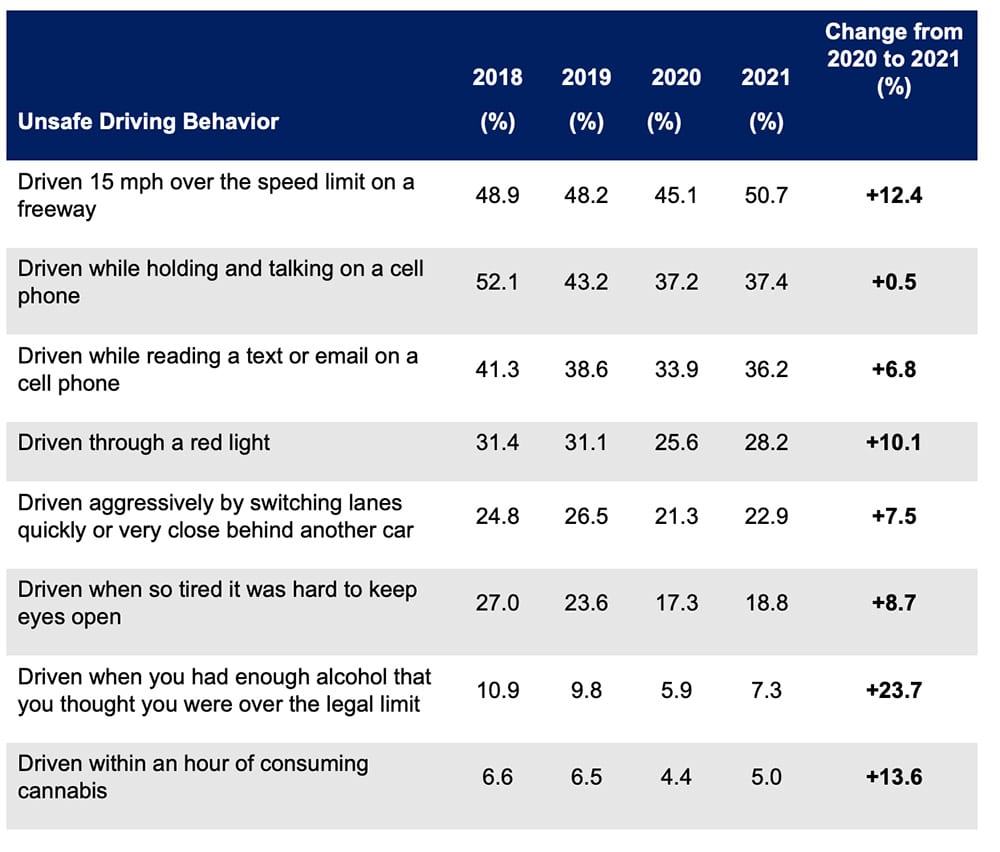

According to the new study from the AAA Foundation for Traffic Safety, the rise in risky behaviors included speeding, red-light running, drowsy driving, and driving impaired due to cannabis or alcohol. The most alarming increase was among drivers admitting to getting behind the wheel after drinking enough that they felt they were over the legal limit – an increase of nearly 24%.

“The reversal in the frequency of U.S. drivers engaging in risky driving behavior is disturbing,” said Montrae Waiters, AAA-The Auto Club Group spokeswoman. “While drivers acknowledge that certain activities like speeding and driving impaired are not safe, many engage in these activities anyway. This reckless attitude can be life altering.”

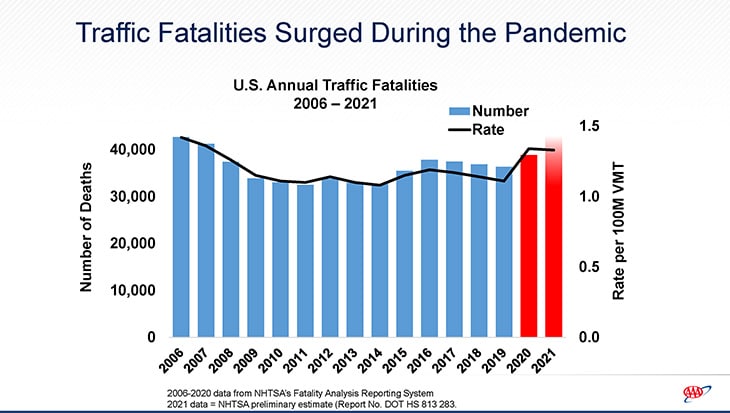

Traffic fatalities have increased since the start of the COVID-19 pandemic in 2020. The National Highway Traffic Safety Administration (NHTSA) estimates that 42,915 people died in motor vehicle traffic crashes in 2021. That’s a 10.5% increase from the 38,824 fatalities in 2020. According to NHTSA, dangerous driving behaviors such as speeding, alcohol impairment, and non-use of seatbelts account for a considerable proportion of the increased fatalities.

The proportion of people who reported having engaged in the following unsafe driving behaviors at least once in the past 30 days before the survey

“Traffic patterns have largely normalized since the start of the pandemic, yet traffic fatalities are at their highest level in nearly two decades,” Waiters continued. “We can reverse this trend if drivers slow down, avoid distractions and never drive impaired.”

As dangerous driving behavior becomes more common on the road, AAA recommends that drivers ensure that they are adequately protected against the growing risks on the road.

AAA Tips for Drivers

• Make sure you are protected with adequate insurance coverage. If your policy does not include uninsured motorist coverage or has low minimal liability limits, you could be stuck paying some big bills out of pocket. AAA offers a free Triple Check to help you understand your insurance coverage—from any company. This analysis will determine whether you have enough coverage without paying for protections you don’t need, and it will help you identify discounts you qualify for with insurance through AAA.

• Be mindful of your own driving habits. AAA members can sign up for AAADrive via the free AAA Mobile App. This tool helps you become a safer driver by giving real time feedback and providing resources that promote safe driving and reduce dangerous activities. It also helps you get a discount on auto insurance with AAA: up to 5% just for enrolling (10% if you enroll every family member on your policy). You could qualify for discounts of up to 25% based on your score. Learn more at AAA.com/AAADrive.

• Be prepared in the event of a crash. Keep an emergency kit with first-aid and roadside visibility items (e.g., flashlight, flares) in your car. You should also keep a copy of your proof of insurance (plus a pen and paper) in your glove box and add your insurance company’s phone number and your policy number to your phone. If you have insurance through AAA, you can view your policy details on the AAA Mobile app.

• Know what to do when a crash occurs. Check for injuries, call 911 and remain at the scene. If no one is injured and your vehicle is drivable, turn on the hazard lights and safely move it to an emergency lane or parking area. If the vehicle can’t be moved, turn on the hazard lights and go to a spot safely away from moving traffic until emergency services arrive. You should exchange information with all parties, take photos of the location, people involved and damaged vehicles, and notify your insurance company as soon as possible. If you are insured with AAA, you can start your claim online, over the phone or via the AAA Mobile app.